What is an MT4 Market Scanner? - Part 2: How it works

Professional trading platforms have a native market scanner, MT4/MT5 doesn't. Is it really needed? If so why can't you just use professional platforms? There are a lot of reasons to use MT4/MT5 so you need a market scanner on MT4/MT5. We see which are the cases and what a market scanner is.

Recap

In Part 1 we have seen that professional platforms have a market scanner while MT4 and MT5 do not.

We have also shown a simple strategy as use case, analyzing some issues related to the lack of a market scanner. Now we see how we can use the market scanner with this strategy.

How does a market scanner work?

With the market scanner, you can create your own rules to see the entire market situation in just one view. There are different types of market scanners, the simple version allows you to just see indicator values while the complex ones allow you to compare multiple indicators one another for situations like the strategy previously analyzed or more complex strategies.

To help immediately understand the situation colors are useful since the human brain is able to understand colors in less time than text, of course colors is not the only way to achieve this but it's the most used to quickly analyze the market.

A simple example

If we consider the previous strategy we want an instrument that allows us to:

- Scan for different symbols

- Scan for different timeframes

- Put green in the screen if we are in up trend so if SMA(15) > SMA(30)

- Put red in the screen if we are in down trend so if SMA(15) < SMA(30)

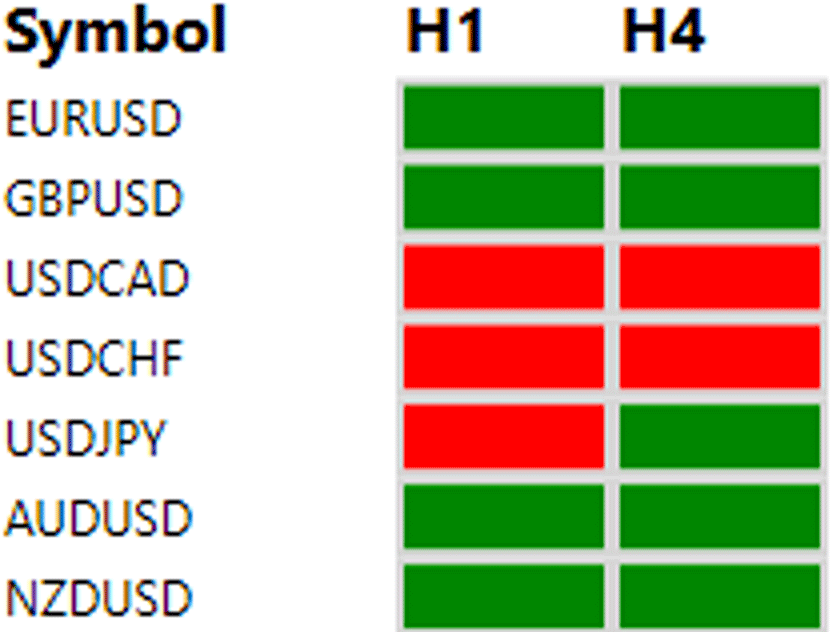

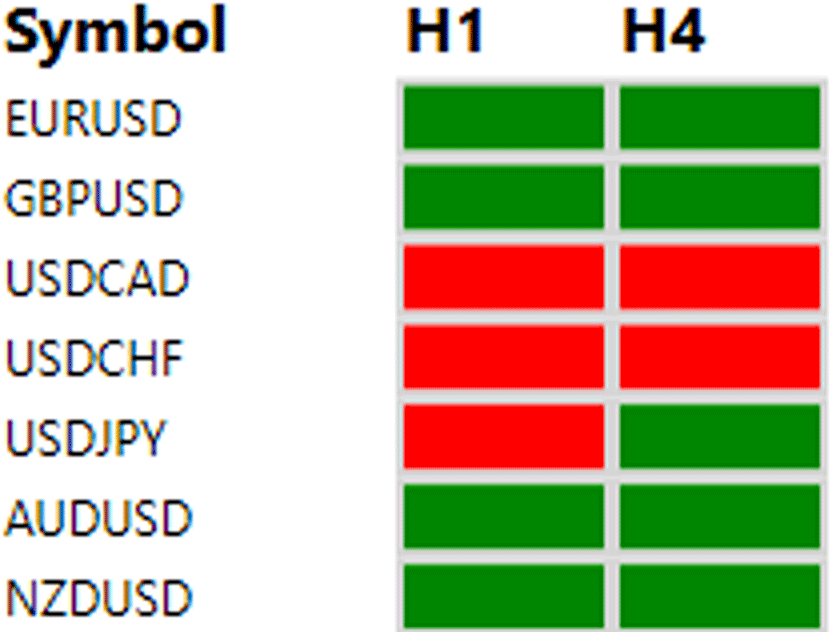

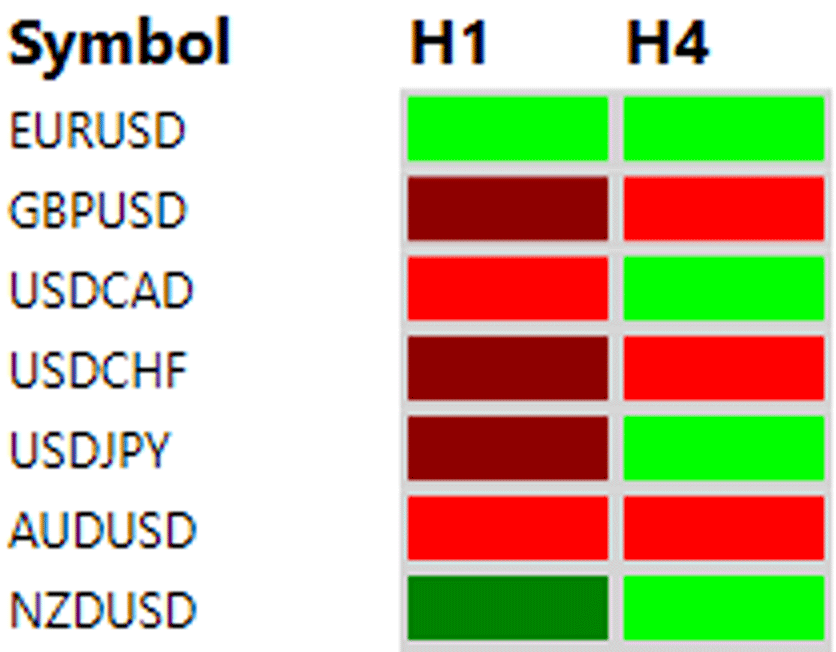

It's easy to understand why a table view is the best way to show this, in fact in the columns we can put timeframes and in the rows the symbols. So every cell will be colored according to the rule we described previously (green/red) for the corresponding symbol and timeframe. If we consider few symbols and just H1 and H4 we'll have a result like the following:

Do you see how easy it is to check the conditions for different timeframes and different symbols, of course this is a simple strategy but don't worry we'll see it also in complex ones.

Often there are some indicators calling themself market scanners, but they are not. In fact, there are some scanners with fixed strategy logic inside that run on different symbols and timeframes, but they are not real market scanners.

For example, if we think to the previous strategy market scanner if this is distributed as a standalone strategy, so a system that scans all symbols and timeframes checking SMA(15) and SMA(30), without the capability to set up rules it won't be a market scanner.

We have an analogous situation in the case where a signal provider generates signals using a market scanner or any other way but giving you only signals, since you do not have any kind of control so you do not have a market scanner but just signals.

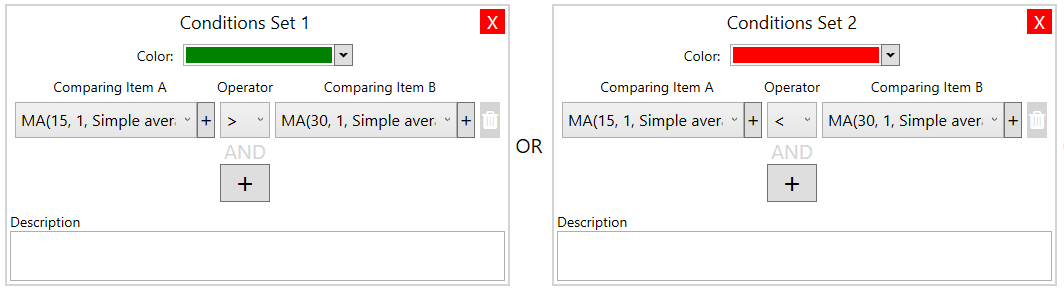

The real market scanner in fact allows you to configure your rules without any programming skills.

Let's see an example where we configure rules to show different colors:

Now do you see the difference? Without any kind of effort you create the rule, you need less time than creating a custom automatic trading strategy.

A more complex market scanner example

We have seen a simple example to understand basic concepts, now we want to perform an analogous thing on a more complex system.

In fact, real strategies often are not based just on SMA, but on complex indicators or some custom (maybe proprietary) indicators and have complex rules considering different scenarios.

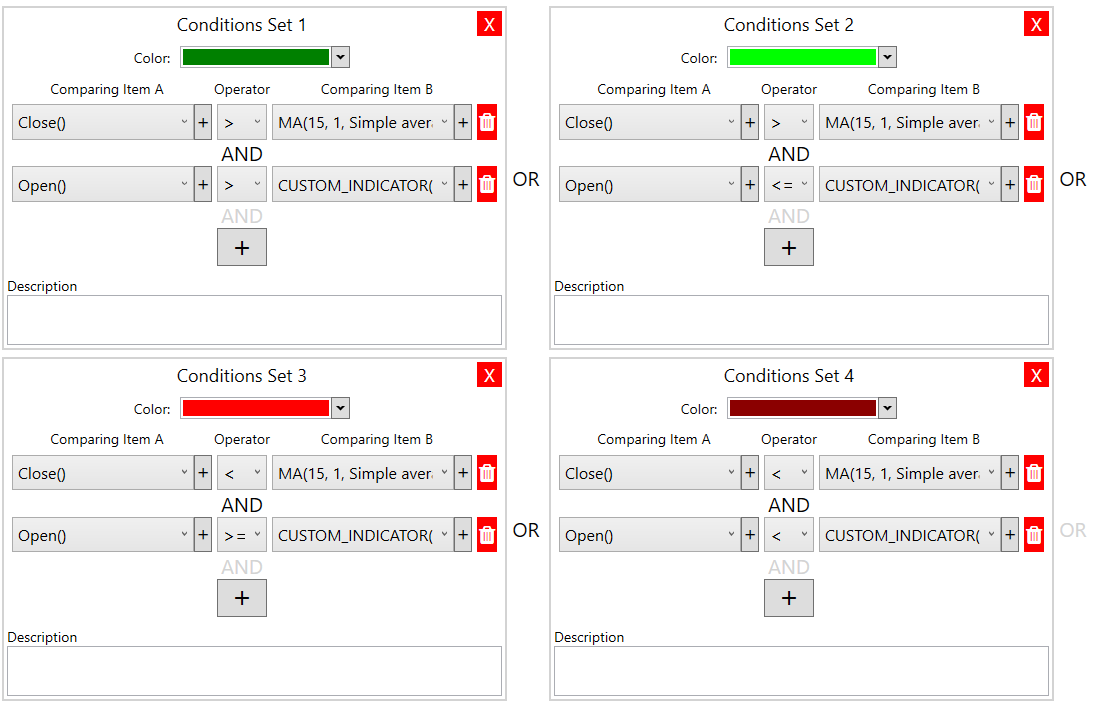

Assuming a generic custom indicator we want to have the following strategy:

- CLOSE () > SMA(15) AND OPEN() > CUSTOM_INDICATOR: Strong up trend and show dark green

- CLOSE () > SMA(15) AND OPEN() <= CUSTOM_INDICATOR: Weak up trend and show light green

- CLOSE () < SMA(15) AND OPEN() >= CUSTOM_INDICATOR: Weak down trend and show light red

- CLOSE () < SMA(15) AND OPEN() < CUSTOM_INDICATOR: Strong down trend and show dark red

With this strategy, we invest only in strong trends, and we start monitoring situations on weak trends. Maybe we could use weak trends for exit conditions but these are just strategy ideas and not related to the market scanner. As you can see the market scanner gives you a lot of freedom for your strategy.

We do not type the MQL code because the article would be too long 😁.

So see directly how this can be achieved with a market scanner and which is the final result.

The effort to create this kind of market scanner is still low and the view is easy to understand with colors, however you can detect a lot of information at a glance.

Of course, a market scanner could have complex strategies and additional elements, for example:

- Cells with multiple colors to give more information

- Texts inside the cells to give indicator values

- Alerts notifications for every color changes

Of course, any kind of strategy can be implemented not only trend following strategies like the ones we have seen in the examples.

Conclusion

We have seen how a market scanner works in details, looking also at a complex example.

We conclude in Part 3 analyzing which are the MT4/MT5 solutions.